- TUESDAY, JULY 2, 2024

Analyst: The local real estate market is frozen

With sales slowing, prices holding steady and ‘Days on Market’ mixed, the real estate market may be in a state of flux

A review of the cities and towns up and down the East Bay, from Newport and Little Compton to East Providence, comparing the first quarter of 2022 to the first quarter of 2023, shows that unlike our …

This item is available in full to subscribers.

Please log in to continue |

Register to post eventsIf you'd like to post an event to our calendar, you can create a free account by clicking here. Note that free accounts do not have access to our subscriber-only content. |

Day pass subscribers

Are you a day pass subscriber who needs to log in? Click here to continue.

Analyst: The local real estate market is frozen

With sales slowing, prices holding steady and ‘Days on Market’ mixed, the real estate market may be in a state of flux

A review of the cities and towns up and down the East Bay, from Newport and Little Compton to East Providence, comparing the first quarter of 2022 to the first quarter of 2023, shows that unlike our past winter, the residential real estate market is frozen!

The high interest rates have frozen would-be sellers in their tracks. Many sellers are “trapped” by their low interest rates of 3% or less and won’t think about a move until rates come down. So sellers are sitting on the sidelines until there is some clarity to what happens next.

Have rates peaked? Will they go higher? Will they start their descent? Will more banks go belly up, like the recent collapse of Silicon Valley Bank (SVB) and Suisse Credit, which has spooked Wall Street and the regular Joe and Josie on Main Street.

Uncertainty in the financial markets and high interest rates have cast a pall on the financial and real estate markets alike. Similarly, both the stock market and the real estate market are up and down, with no trending direction.

In the meantime, buyers are stacking up behind less and less inventory. The run-up in rates over the past nine-plus months has certainly slowed buyers’ appetite for real estate, as more and more buyers are up against an affordability crisis. Between the high cost of housing and the high cost of borrowing, many would-be buyers are also frozen out of the market, which puts more and more pressure on the rental market.

The Federal Reserve is now caught between a rock and a hard place. Do they keep inching interest rates up to tame inflation or do they relax rates, so more banks won’t collapse? A conundrum for sure.

The Feds’ most recent ¼% increase at the moment favors slowing inflation, but for how long and if more banks go down, will they change direction?

Sales are slowing almost everywhere

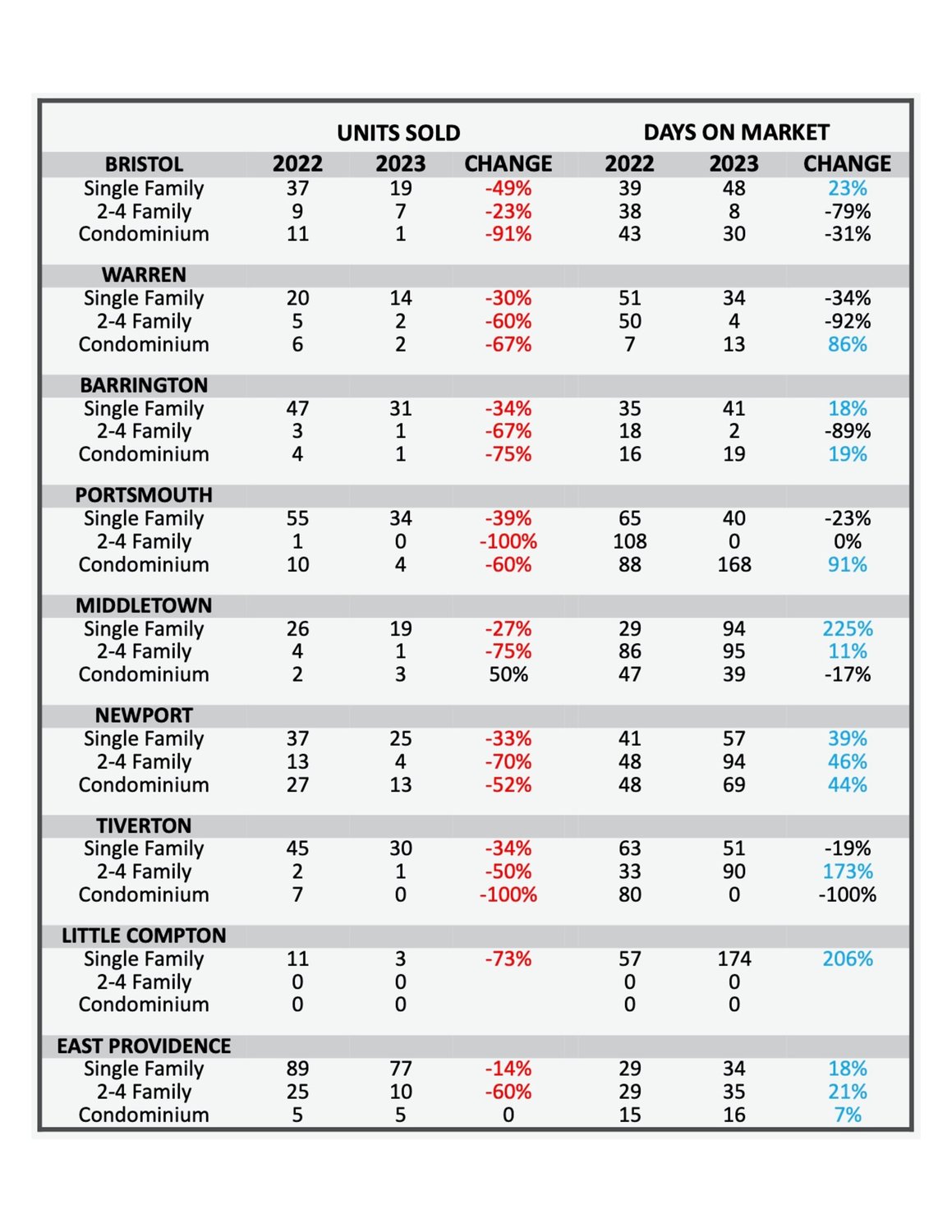

A review and analysis of residential real estate units sold and days on market (DOM), comparing the first quarter of 2002 to the first quarter of 2023, reveals a trend of slowing price increases but not yet declining prices, as well as a lack of inventory.

With a couple of exceptions, every city and town throughout the East Bay shows a decline in units sold, whether it be a single-family homes, multi-family or condominium residences. All units-sold have decreased from the first quarter of 2022 to the first quarter of 2023. However, sale prices are mixed comparing the same first quarter.

For example, the single-family median price in Bristol is stable, but it increased in Warren by 25% and in Barrington by 20%. In Newport County, Portsmouth single-family prices decreased by almost 20%, Middletown increased by 20+%, Newport was stable, Tiverton also decreased by 10% and Little Compton decreased by 15%. This data needs to be analyzed with the understanding that the data pool is small and therefore is not necessarily indicative of a trend when comparing only three months vs. a year or multiple years.

At the moment, this market is confused

However, I would opine that, unlike the past few years when all the data pointed up, what we are seeing now in the first quarter is a transitioning real estate market that does not know what direction it is going just yet.

The 2-4-family market in the East Bay is largely centered around Bristol, Warren, Newport and East Providence, and that market shows resiliency and continued upward values. All four communities saw increases from 11% to 111% in their 2-4-family median sale prices.

The condominium median price also increased in six of the nine cities and towns, with the exception of Barrington, East Providence and Little Compton, where the dataset was too small to be a reliable indicator of market activity. In the six communities of Bristol, Warren, Portsmouth, Middletown, Newport, and Tiverton, the median price increased on average by $122,000.

The only trend I can discern at this point is that data indicators are mixed and that a mixed trend is likely to continue throughout 2023. Certainly, the high prices and increasing interest rates will continue to impact buyers’ ability to buy. Until sellers feel like there is some certainty in the market, will they decide to sell and add to the extremely low inventory currently on the market?

I’ll update you in a column in early July after assessing where the data leads at the midway point of 2023. Until then, enjoy all Spring has to offer us in the East Bay, the Cherrystone of Rhode Island!

Douglas Gablinske owns AppraiseRI, a 27-year-old statewide real estate company located in Bristol, RI. He is Chairman of the Warren Taxpayer Appeal Board and was recently appointed to serve on the Rhode Island Real Estate Appraisal Board, which oversees licensing of Rhode Island real estate appraisers, as well as reviews complaints made against appraisers and recommends legislation to the legislature relative to the real estate appraiser profession. He can be reached at doug@appraiseri.biz.

Other items that may interest you