- TUESDAY, JULY 16, 2024

Portsmouth's proposed budget calls for 39-cent tax rate hike

Council grapples with unexpected $58K shortfall for schools

PORTSMOUTH — Town Administrator Richard Rainer Jr.’s proposed municipal budget for fiscal year 2025 starting July 1 calls for a 39-cent increase in the tax rate …

This item is available in full to subscribers.

Please log in to continue |

Register to post eventsIf you'd like to post an event to our calendar, you can create a free account by clicking here. Note that free accounts do not have access to our subscriber-only content. |

Day pass subscribers

Are you a day pass subscriber who needs to log in? Click here to continue.

Portsmouth's proposed budget calls for 39-cent tax rate hike

Council grapples with unexpected $58K shortfall for schools

PORTSMOUTH — Town Administrator Richard Rainer Jr.’s proposed municipal budget for fiscal year 2025 starting July 1 calls for a 39-cent increase in the tax rate — approximately 3.1 percent more than the current rate.

Under Rainer’s spending plan, the tax rate would go from the current $12.78 to $13.17 per $1,000 in assessed valuation.

That means the owners of a property assessed at $450,000 would see their tax bill increase from the current $5,751 to $5,926.50 next year, or $175.50 more. The owners of property assessed at $600,000 would be taxed $7,902 next year — $234 more than what they pay now.

The total budget calls for $74,346,959 in expenditures, an increase of 3.94 percent over the current spending plan. The total property levy on residential, commercial, and tangible property would increase by 3.66 percent, to $64,172,831. That’s below the state-mandated cap of 4 percent, Rainer noted.

Before the Town Council Monday night, the administrator detailed several major drivers for next year’s budget, including another decrease in state aid for schools. “On average, Rhode Island municipalities receive more state and federal educational aid than Portsmouth, and can afford to draw less required property taxes from residents,” he said.

Other drivers include the elimination of the car tax, bond debt service, the expiration of several grants including the Elementary and Secondary School Emergency Relief (ESSER funds), contracted salaries and increased health care costs, and more.

Most of the town expenditures are non-discretionary, “meaning we are contractually obligated to commit funding, or we are legally obligated to pay off borrowed funds. A little over 2.6 percent of the total budget represents the discretionary spending by town departments compared to the entire budget,” Rainer said.

The administrator, in his budget letter to the council, said the proposed tax rate “strikes a balance between prudence and maintaining essential services, grounded in conservative revenue and expenditure forecasts.”

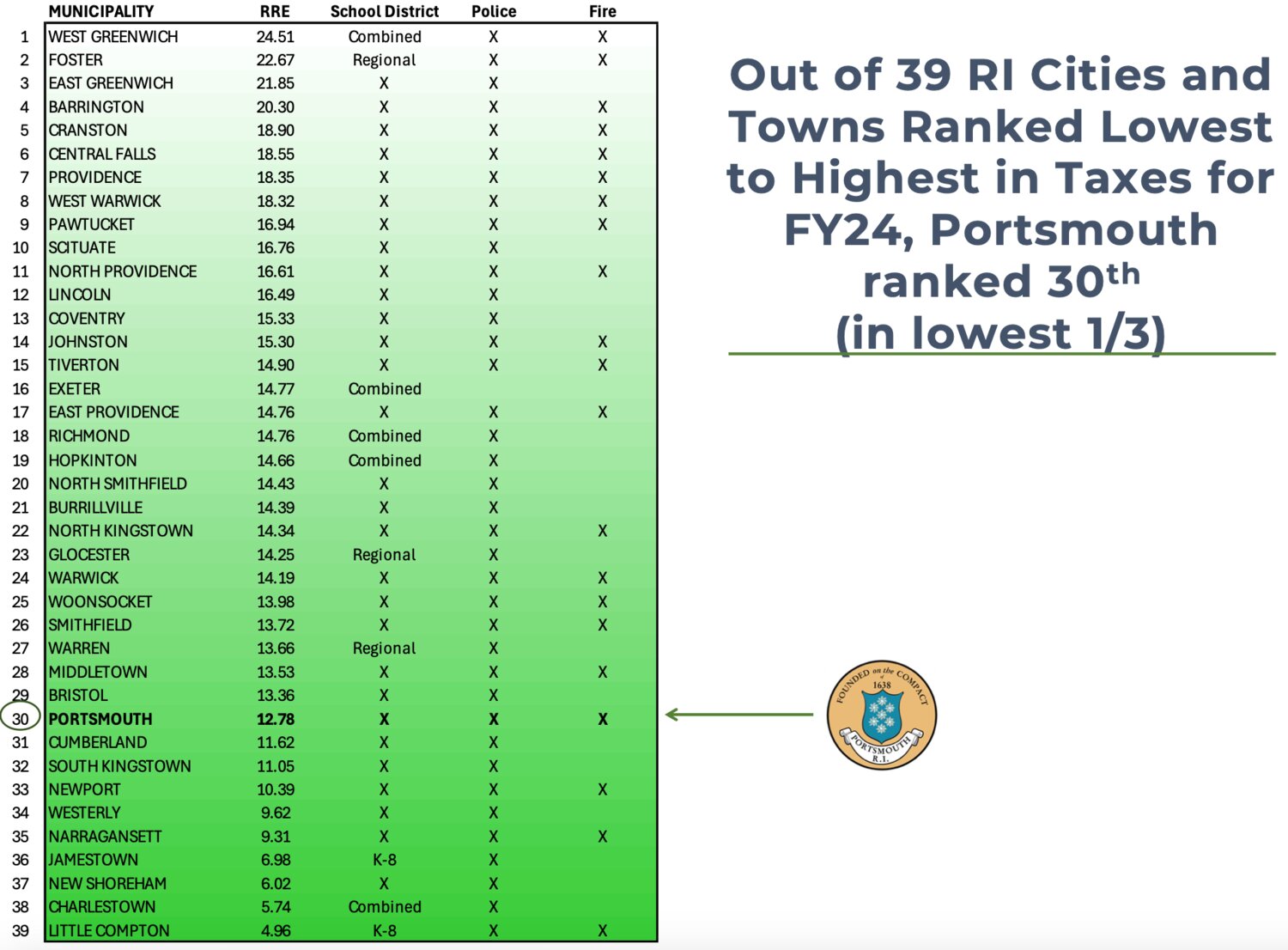

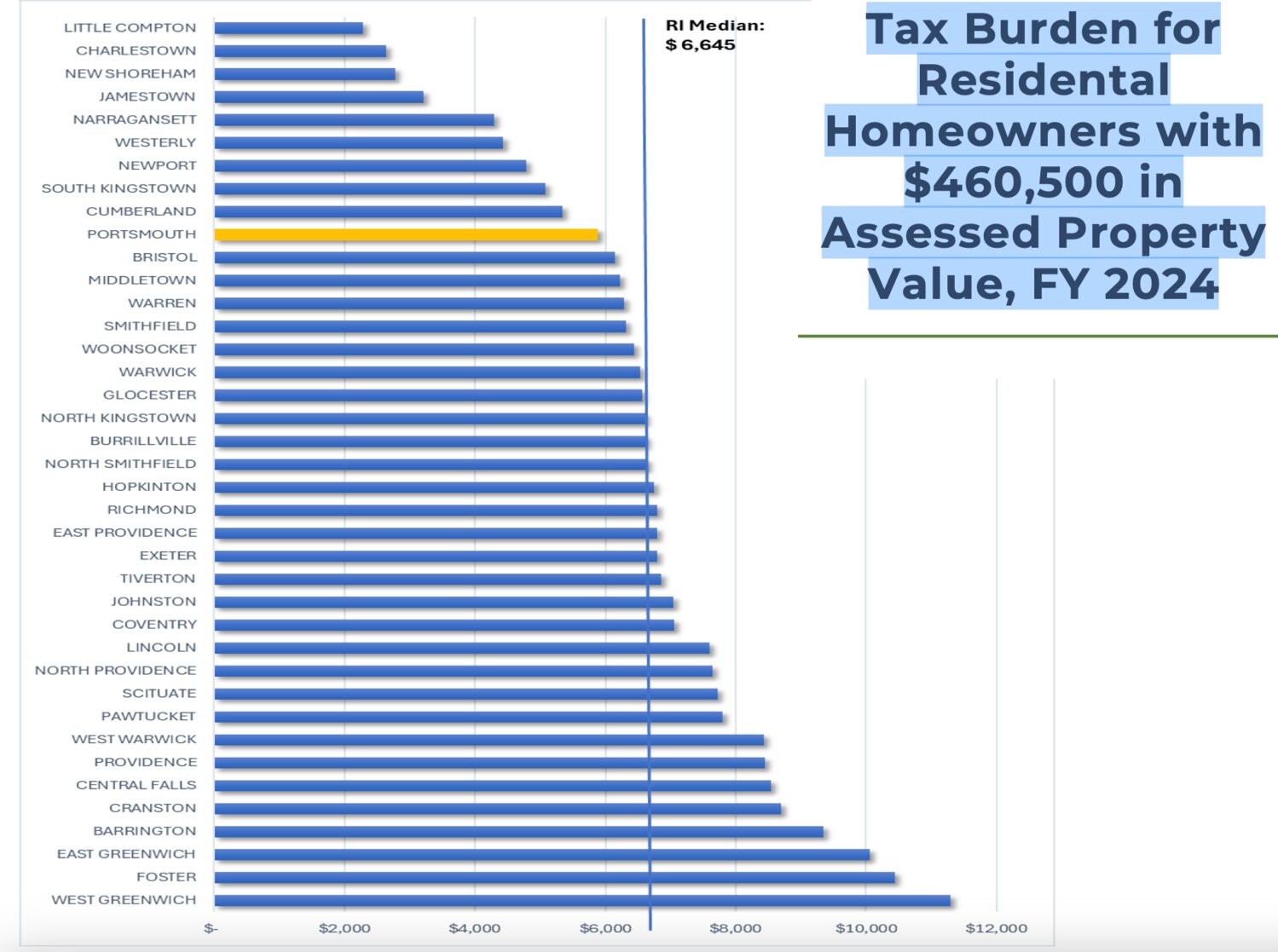

Despite this year’s budget challenges, Rainer displayed graphics that he said showed how Portsmouth’s tax burden on residential homeowners was below the Rhode Island median.

“Our tax rate was 10th lowest relative to the rest of Rhode Island. Our proposed tax rate of $13.174 would place us well into the bottom third of the state,” he said. Out of 18 cities and towns with like services — a professional police and fire department, and K-12 school district — “our proposed tax rate would put us in the bottom four of towns and cities offering those services,” he added.

Cites state’s high taxes

Larry Fitzmorris, president of the taxpayer watchdog group Portsmouth Concerned Citizens, took issue with Rainer’s favorable comparison of the town’s tax burden to other Rhode Island municipalities.

The Tax Foundation ranks Rhode Island No. 42 out of the 50 states when it comes to property taxes, and Forbes places the Ocean State at No. 39, he pointed out.

“We are bumping up against a maximum here,” Fitzmorris said. “If we compare ourselves to the rest of the state, and the state is too high in property taxes, then that’s not a relevant comparison. We should be comparing against what we can afford to pay, as opposed to what somebody else is being overcharged.”

Council member Charles Levesque then asked Fitzmorris, “Are they also looking at the ability of the people of the Town of Portsmouth to pay? Most of the country does not rely on property tax as much as the New England states do."

Council President Kevin Aguiar said he also believed it was fair to draw a comparison between Portsmouth and other municipalities when it comes to property taxes.

Tuesday night: Schools

The budget presentation and review continued Tuesday night, which was devoted mainly to the School Department that makes up 56.1 percent of the town’s expenditures. (Public safety takes up another healthy chunk: 22.3 percent.)

The school district is proposing total expenditures of $44.64 million for next year — a $1.33 million (3.1 percent) increase, said Superintendent Thomas Kenworthy. Adding in another estimated $2.23 million in restricted funds and the total school package comes to $48.87 million, a 3.5-percent increase over the current spending plan.

The school budget requires a town appropriation — the amount raised through property taxes — of $38.21 million, an increase of 2.7 percent.

The increase in expenditures “was driven primarily by contractual obligations and increased costs tied to the rate of inflation,” said Kenworthy, adding that employee compensation is up 2.9 percent and benefits, 1.7 percent.

“Throughout our budget development process … expenditures were reduced by over $890,000 to get to these numbers, driven primarily by the reduction of 7.2 staff members, based on enrollment projections and the end of COVID-related ESSER funding,” he said.

As for revenue, the district is expected to lose about $100,000 in state educational aid. That’s nothing new, as Portsmouth schools have lost about $500,000 over the past five years and $2.3 million cumulatively since 2011.

The expected shortfall of $100,000, however, has been offset by increased revenues from the district’s tuition agreement with Little Compton, which sends its high school students to PHS, as well as an increase in out-of-district career and technical (CTE) program tuitions, the superintendent said.

Little Compton tuition is projected at $1.27 million for 2025, a $101,000 (8.6 percent) increase over the current figures. CTE enrollment projections are even better; tuition is expected to increase by nearly $300,000, a 41.3-percent hike over the current numbers.

“It is worth noting that Portsmouth High School now has six RIDE-approved CTE programs which allow us to tuition in students from other districts. When we started our initial programs in 2016, we welcomed five out-of-district students. Next year, we are projected to have over 60,” said Kenworthy.

The $58,000 question

While the district’s proposed 3.1-percent increase in expenditures is below the rate of inflation, Kenworthy said, it does not include approximately $58,000 in healthcare premium rate increases which came in after the School Committee approved the budget on March 12. The unanticipated funding shortfall was a source of lively debate between council members Tuesday night.

Council member Keith Hamilton suggested a collaborative approach in finding the money for the schools. “I believe we can do it within the budget that we currently have,” he said.

Noting there’s a $52,000 request to hire an assistant IT person in the town’s budget, Hamilton suggested holding that funding until later in the budget process. If it appears the schools still need it, the funds could be released to make up the shortfall and perhaps the district could assist the town’s IT department “to fill that gap,” Hamilton proposed.

Council members Charles Levesque and Leonard Katzman, however, said they didn’t want to sacrifice anything in the town’s IT line. “Year after year after year, among the things people say needs improvement is our IT infrastructure,” said Katzman. “I think that’s a necessary position.”

Levesque agreed. “We are woefully short in IT. The idea of delaying it doesn’t seem to be a good idea,” he said, adding he believes the town has the resources to fund the $58,000 shortfall.

Hamilton, however, remained convinced the money could be found in the existing proposed budget. “Over the past roughly 10 years, we have funded the School Department to specifically what they’ve asked for, and each year they’ve come back with a surplus,” he said.

Council member David Gleason also supported passing the school budget provisionally as it was presented. “We will find a way to get $50,000 some way by taking it out of the town’s side somewhere,” he said.

The council then voted 4-1, with Levesque in the minority, to provisionally approve the total school budget of $46.87 million. Council members Daniela Abbott and J. Mark Ryan were absent Monday and Tuesday nights.

What’s next

The council was expected to wrap up its budget review on Wednesday of this week. The provisional budget will be adopted May 13, and a public hearing is set for June 12. Changes can still be made to the spending plan before it’s formally adopted on June 24.

Keywords

Portsmouth Town CouncilOther items that may interest you