Tax impact for Bristol Warren school bond on target with taxpayer promises

Updated financial impact calculations showed that the projected tax implications for residents in Bristol and Warren have remained consistent with what district officials promised prior to the bond's approval in 2023.

This item is available in full to subscribers.

Please log in to continue |

Register to post eventsIf you'd like to post an event to our calendar, you can create a free account by clicking here. Note that free accounts do not have access to our subscriber-only content. |

Day pass subscribers

Are you a day pass subscriber who needs to log in? Click here to continue.

Tax impact for Bristol Warren school bond on target with taxpayer promises

New math calculating the projected tax impact of a school bond approved by voters during last November’s special election did not cause panic alarms to sound throughout the Reynolds School in Bristol during a recent meeting of the Bristol Warren School Building Committee, as members learned that impact looks much the same as it did prior to when voters in both Bristol and Warren approved up to $200 million to build a new high school and make renovations across the district.

“Right now we’re coming in a little bit under budget, and that includes building in generously for contingencies and such,” said Nicky Piper, chairperson of the School Committee, during a recent interview discussing the updated projections.

Since January — when the committee learned that the Rhode Island Department of Education (RIDE) would only reimburse up to $157 million in construction costs — project managers, architects, and the committee members themselves had been working to adjust the scope and scale of the overall school bond project, which includes the construction of a new Mt. Hope High School and renovations to all other schools in the district, in order to match the initial anticipated tax impact that residents in Bristol and Warren would experience as a result of the borrowing.

How does the math shake out for each Town?

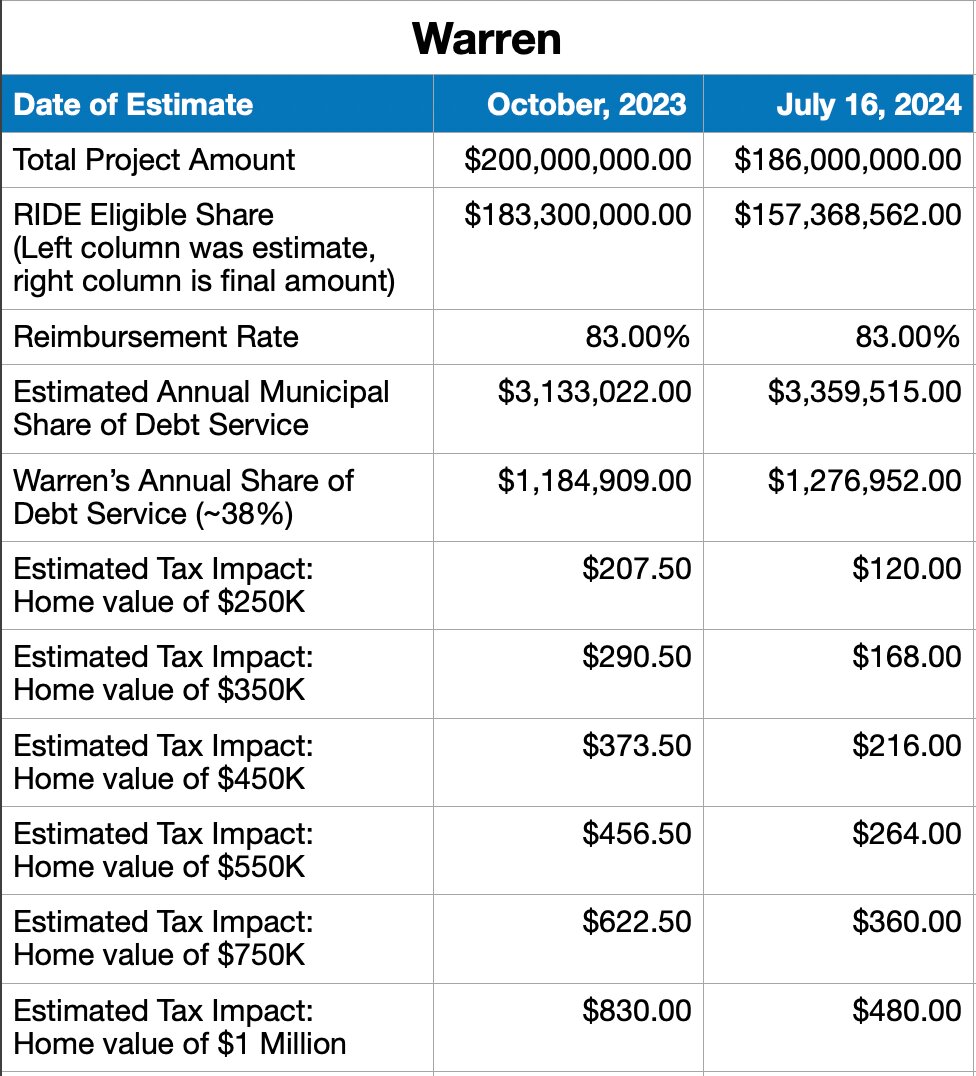

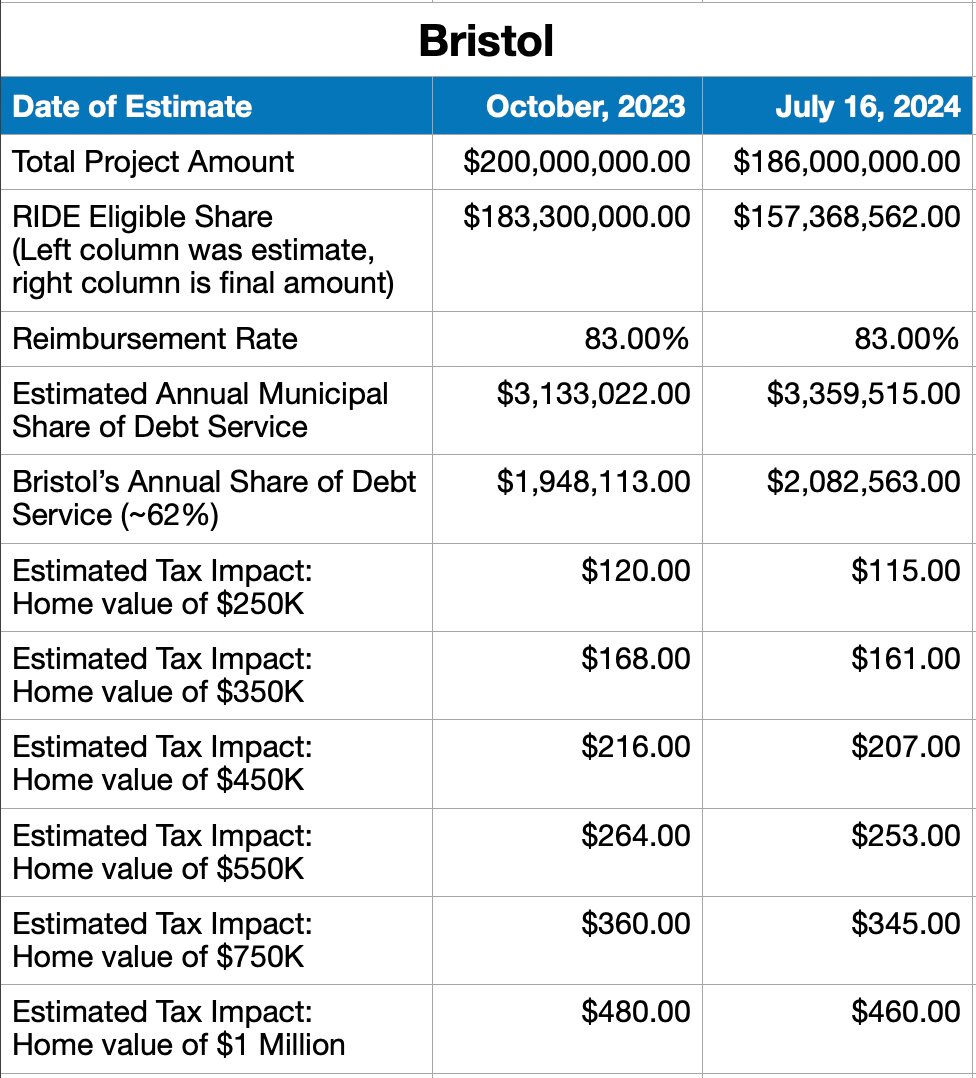

School officials and those supporting the bond initiative sold the plan on the notion that, in the event of borrowing the maximum $200 million in bonds, and assuming a maximum 83% reimbursement from RIDE — and accounting for the fact that existing debt from the last school bond would be maturing on May 15 of 2028, prior to the first payment for the new spending coming due — it would result in an annual tax increase of between $120 and $480 for homes in Bristol valued between $250,000 and $1 million, and between $207 and $830 for homes valued $250,000 to $1 million in Warren when taxes become due in Fiscal Year 2028.

The new estimate, which is calculated based on a refined total project cost of $186,000,000, a maximum RIDE reimbursement of 83% of $157,368,562 in eligible costs, and a total bond amount of $167,595,000, shows that the annual tax increase would range from $115 to $460 for homes in Bristol valued between $250,000 and $1 million; a slight decrease from what was initially sold to taxpayers.

In Warren, the situation is a bit more complicated, but still good news for taxpayers keeping a keen eye on how much the bond is going to affect the Town's shaky financial footing following the $13 million lawsuit settlement that came down this past December.

The new estimates from the school district show that, after existing debt matures on May 15, 2028, residents can expect tax increases of between $120 and $480 for homes valued at $250,000 to $1 million.

Part of the reason for this seemingly steep decline in projected tax increase is because Warren significantly raised its tax levy to the tune of more than 5% during the most recent budget season — in no small part due to making the first of three $1 million payments to help settle that aforementioned lawsuits. Thankfully, that last payment will be made in Fiscal Year 2027, and the first bond payment will be coming online in Fiscal Year 2028, resulting in a lower tax impact due to the higher volume of tax dollars already raised from this most recent budget.

See the table for a complete breakdown of estimated tax impact based on home values. You can corroborate these calculations yourself by utilizing this updated tax calculator linked here.

It should be noted that the district will be receiving a total reimbursement from RIDE amounting to $209,751,298. This includes 100% reimbursement from the state on interest accrued over the life of the 30-year bond, plus $18,405,000 in “Pay-Go” funding, which is money that is made immediately available to the district to pay for up-front construction costs such as design/engineering reports for projects.

Add/alternates list is the next priority

Piper said during the interview that the next big step for the committee is the whittle down a list of some 260 items that the team has amassed that have been set aside from the project scope as “add/alternate” items. These include big ticket items, like installing a cutting edge geothermal heating system at the high school for around $9 million, or adding a grand stand at the track for $1.8 million, to lower cost items like making improvements to curbing and lighting at schools throughout the district.

“We need to get the add/alternate list to something much more concise,” Piper said. “Interest rates seem to be working in our favor and so Chad [Crittenden, from PMA Consultants, the district’s project management team] seems hopeful we’ll be coming in even more under budget so we can add in some of those add/alternate items.”