'If you can spot a scam, you can stop a scam'

Sen. Reed, RI AARP and State Police visit East Providence to spread elderly scam awareness

By Ethan Hartley

Posted 10/11/24

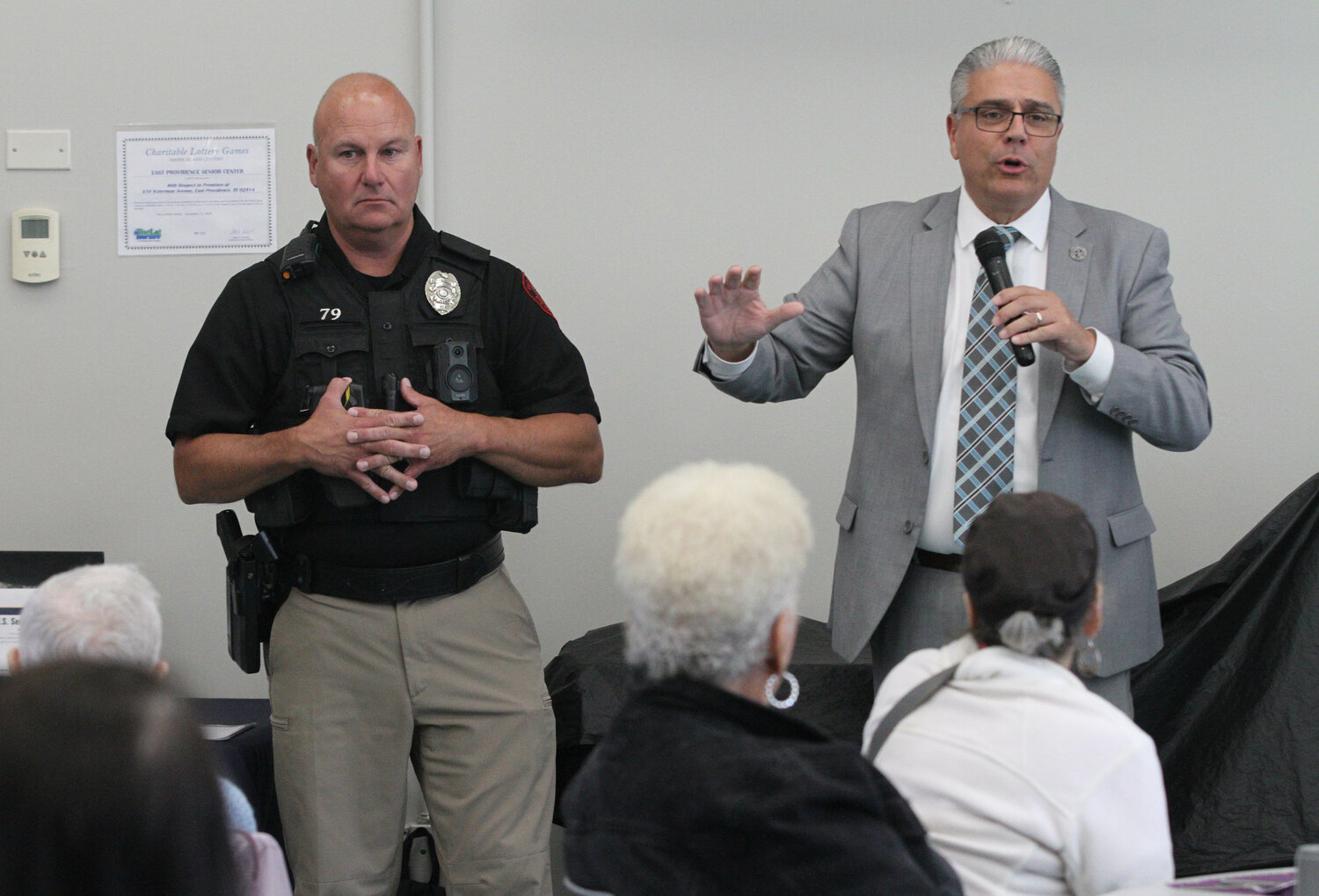

Senator Jack Reed, the RI AARP, and the Rhode Island State Police visited the East Providence Senior Center on Thursday, Oct. 10 to spread awareness about common scams used to victimize elderly people, and what they can do to prevent it from occurring.

This item is available in full to subscribers.

Please log in to continue |

Register to post eventsIf you'd like to post an event to our calendar, you can create a free account by clicking here. Note that free accounts do not have access to our subscriber-only content. |

Day pass subscribers

Are you a day pass subscriber who needs to log in? Click here to continue.

'If you can spot a scam, you can stop a scam'

Sen. Reed, RI AARP and State Police visit East Providence to spread elderly scam awareness

Posted

With one phone call, Riverside resident Roderick Annis had his life, and his retirement, turned upside down.

“It was a fraud that indicated I had won money, deposited by Publishers Clearing House. I had been members of theirs for many decades,” he said. “They gave me a lockbox number and a PIN number to get into it. It was all done by computer.”

When Annis called the number, he spoke to people who took the account information and confirmed the good news. There was $1.5 million in an account for him ready to be claimed. All he had to do was cut a check to pay a fee to unlock the account.

He followed the instructions, and then was asked to go through the process a second time, and then was asked to do it a third time, and when he finally got through to see the bank account that supposedly held the money, he was met with a deleted page.

“I thought, ‘Oh no, I’m up the creek.’”

In all, scammers had fleeced the then-80-year-old out of $122,000 – a full one-third of the money that he had saved in retirement. He initiated an investigation, first with the East Providence Police Department, that has now risen all the way up to the FBI and other federal authorities, as it is being treated as an international fraud case.

That was back in 2023, and Annis still doesn’t know if he’ll ever see a penny of restitution.

“I’m waiting patiently but I’m not going to hold my breath,” he said.

A statewide public awareness campaign urging senior citizens to be aware of bad actors – like the ones who targeted Roderick Annis – visited the East Providence Senior Center on Thursday. Mayor Bob DaSilva underlined the core purpose of the event in his introduction of the speakers in attendance.

“It’s important to highlight that there are people out there that will prey upon the elderly,” he said. “And it’s important to know the signs and the things to look for.”

How to avoid a scam

Rhode Island Senior Senator Jack Reed was first to the podium, and he began asking the room of seniors who had gathered if any of them had been victimized by a scam or attempted scam. A few raised their hands.

“Well, it’s going to get more and more common, unfortunately, because the technology is becoming incredibly more powerful,” he said.

Reed spoke about the increasing use of artificial intelligence by scammers, who can now use software to mimic the voices of family members and loved ones expressing that they are in a dire situation – like they’re in police custody and need bail money – creating an urgent, immediate crisis that puts the victim into a reactionary state of panicked urgency where they don’t think about the possibility of the call not being legitimate.

Lieutenant Richard D. Ptaszek, who heads the Rhode Island State Police Financial Crimes Unit, emphasized that no situation involving a court or a law enforcement office will ever necessitate an urgent phone call forcing you into immediate action involving money.

“They’re [scammers] going to reach out to you with some type of urgency that it has to be done now,” he said. “There's a deadline, the court is going to close, don't tell anybody about it, there's a gag order at the court. None of that is ever true in reality with law enforcement, courts, or anything like that. You’re never going to get a call from a police officer saying you have to come down to the station right now with a bag full of money to bail somebody out.”

Senior resident Christine Singleton stood up to share her own story, which was carried out over the course of multiple contacts with the scammer.

“It doesn’t always happen with one phone call,” she said. “It can happen over time.”

Lt. Ptaszek emphasized the truth in that statement as something seniors should also be aware of.

“The romance scams, the investment scams, they take time. You can be talking to these people for four, five, six months before they ask you for money,” he said. “But all of the sudden, you’re friends. This is not a stranger you just met today or yesterday, it’s somebody you’ve known for six months. And that’s how they groom you into thinking you’re friends now, and then they ask for $5, $10, a gift card for $50. And you send it, and then before you know it, you’re thousands and thousands of dollars into it because it’s your friend and you think you know them.”

The speakers emphasized the best thing people can do is exercise caution and not be afraid to contact someone to ask them if what they’re being told could possibly be a scam.

“Never be embarrassed to ask somebody you trust if you [experience] something like this,” Senator Reed said. “You will find out when you talk to someone else, you will come to the conclusion that this can’t be right.”

“You have to take the time to stop and pause and think about these things,” said Lt. Ptaszek. “They’re going to try to focus on the urgency of it, they’re going to try to manipulate you, to not talk to anybody…Don’t be afraid to go talk to somebody about it. Don’t be afraid to come to law enforcement or be embarrassed.”

Catherine Taylor, Director of the Rhode Island AARP, said that the best way to avoid being scammed is to raise awareness and education about various types of scams, and how to respond to them.

“We like to say if you can spot a scam, you can stop a scam,” she said.

Taylor said that people could take other tangible steps as well, including the use of more complex passwords online, enabling multi-factor authentication where a text message is sent to the user to confirm their password, reviewing your credit report on a regular basis to check for suspicious activity, allowing automatic security software updates on your computer, and avoiding clicking on links or taking phone calls from anybody you don’t know.

Taylor also recommended seniors sign up for scam awareness newsletters and podcasts through their Fraud Watch Network online, and that if they have been victimized, to call their support line at 1-877-908-3360, which is open Monday through Friday from 8 a.m. to 8 p.m.

Common scams, and changing the narrative for victims

Taylor, Reed and Lt. Ptaszek all spoke about the various ways that scammers get money from their victims. Common tactics include asking the victim to pay for pay for false debts or fees through gift cards, and an increasingly popular method has the victim deposit funds into cryptocurrency ATMs, where the money is harder to trace and can be immediately captured by the scammer.

Taylor said that a 2022 AARP survey revealed that 1 in 3 adults said they were personally asked to purchase a gift card to pay for a fabricated debt or obligation, or to claim a prize. The frequency of this scam led to AARP supporting a bill that passed last legislative session that requires stores who sell gift cards to display signage alerting customers of the scam tactic.

Taylor said that legislation bringing more regulations to cryptocurrency ATMs was next on their agenda, as there are already more than 120 of them just in Rhode Island.

“These kiosks are frequently used in government imposter scams, romance scams, grandparent scams, fraudulent online sales, employment scams, lottery scams, and more and more,” she said. “Criminals direct unsuspecting consumers to these ATMs because there are no transaction limits, the money is very hard to trace once transferred. This will be a priority issue for AARP in the next session of the General Assembly.”

Taylor said that AARP tries to dispel the notion that only senior citizens are victimized by these types of criminal behavior. She said that younger people actually report more instances of scams than older individuals, but the older individuals who get scammed report far more severe financial losses from these events.

“Why? Because we’ve had a lifetime to earn and save, and the criminals know that,” she said, adding that it was important to destigmatize the narrative around victims who get scammed.

“There’s a false narrative that older people are gullible or forgetful or easy marks, and that’s just not true. It’s not your fault if it happens to you. The fact is these usually offshore criminals are well organized, well-resourced, and highly skilled,” she said. “The victim didn’t ‘fall for it’, it was a crime. We need to change how we talk about fraud to remove the shame, which keeps so many of us from talking about it or reporting instances of fraud.”

An emphasis on prevention

After the event, Senator Reed held a brief media breakout, where this reporter asked him if the United States was doing enough to hold scamming syndicates – which often operate in other countries – accountable for their actions against Americans.

While Reed said that federal agencies were trying to work with other countries to root out and disrupt these scamming networks, prevention remained the best method for people to protect themselves.

“Prevention is more effective because some of these syndicates have connections to national authorities. The North Koreans basically try to pay for their entire government by shaking down the world with Bitcoin and other cryptocurrency and stealing. It’s difficult to penetrate those systems,” he said. “And then there are criminal networks that are very sophisticated, and they have technology that is good and sometimes better than our own police departments.”

“The first line of defense is informing people of the danger and making them aware.”