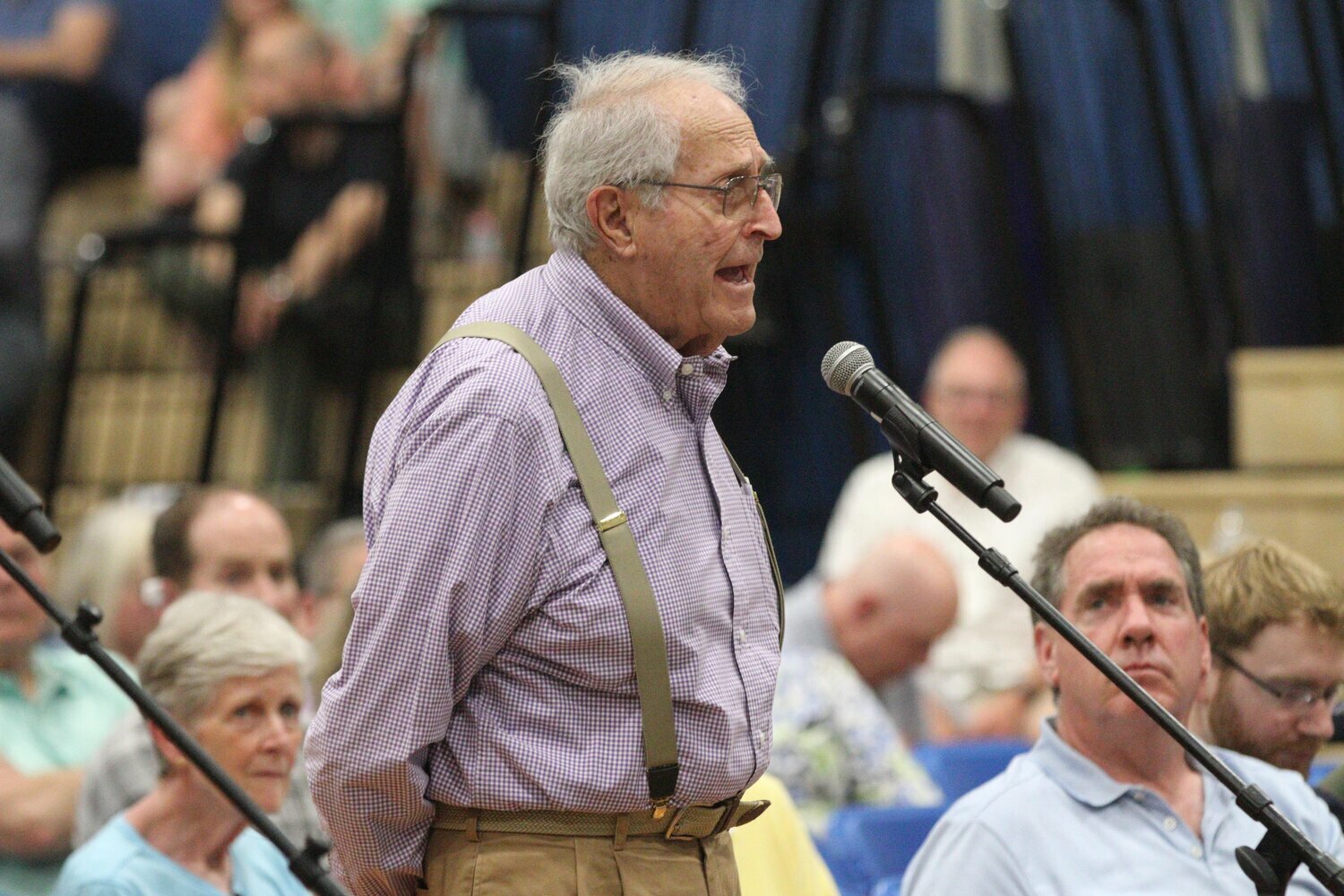

Longtime Barrington resident pitches senior tax break plan

Allan Klepper eyes Spencer Trust to help with potential program

Allan Klepper believes he has found the answer.

The longtime Barrington resident said he discovered information about a tax relief program offered in a Canadian province that could be tweaked to …

This item is available in full to subscribers.

Please log in to continue |

Register to post eventsIf you'd like to post an event to our calendar, you can create a free account by clicking here. Note that free accounts do not have access to our subscriber-only content. |

Day pass subscribers

Are you a day pass subscriber who needs to log in? Click here to continue.

Longtime Barrington resident pitches senior tax break plan

Allan Klepper eyes Spencer Trust to help with potential program

Allan Klepper believes he has found the answer.

The longtime Barrington resident said he discovered information about a tax relief program offered in a Canadian province that could be tweaked to fit Barrington’s needs.

Klepper said his research could be a game-changer for senior citizens who have lived in town for a long time but are struggling to afford the annual tax increases in Barrington. The town has been exploring different ways to help older residents stay in town, amid escalating tax bills.

Klepper has taken it upon himself to dig deeper into the issue and recently approached the Barrington Town Council with one possible solution.

Klepper, who worked for more than a decade as a town manager in Massachusetts, said Barrington could offer the tax breaks — he used a $1,000 tax reduction as an example — to those who qualify. Klepper said those qualifications could be established by town officials, incorporating the resident’s age and length of time in town as possible factors.

In exchange for the tax break, the town would place a lien on the resident’s property, Klepper said. Eventually, when the resident either passed away or decided to sell their home, they (or their heirs) would need to pay back the money owed for the taxes delayed. Klepper said Barrington could also include a nominal interest rate on the taxes delay.

“For $1,000 a year, at the end of … 12 years, it’s $12,000. With a small interest, like 2 percent, you pay $14,000,” Klepper said during a recent interview. “It’s not like a reverse mortgage where you lose the whole house and the heirs are really upset. This would be a micro-reverse mortgage. Miniscule.”

Klepper, who is in his 80s, said town officials could set the rules on who qualifies for the program.

“To start with, I initially figured, I said ‘At least 60 years in town… that you’ve lived here 60 years,’” Klepper said. “The reason I did that is because we (the Kleppers) came (to Barrington) in ’65. And I knew that when I made my initial proposal, if I was included in it, right away someone would say ‘You’re trying to get something for yourself.’”

Klepper said that is not the case — he said he is focused upon helping the local government find a way to help older residents who are struggling to make ends meet.

“I started out trying to save $1,000. As a veteran, I get a couple hundred dollars. Over 65, a couple hundred bucks. But I found that when you’ve been here a long time — you’ve been retired for 20, 30 years — unless you have big investments, you’re living off pensions or you’re living off Social Security. Then the air conditioner goes, the heater goes, the roof goes, the deck goes, the windows go… big expenses. Here’s the way to help these people,” Klepper said.

He said he discovered, by chance, a program offered in British Columbia where the provincial government helps cities and towns extend tax breaks to residents.

“If a town in Canada in their province, for whatever reason wants to give a tax break, the province gives the town the money they would lose. If you give somebody a tax break, you’re going to lose the funds. The province will reimburse the town and take out a lien on the property,” he said.

Klepper said he studied the program and made a few small changes to fit his proposal to Barrington. He said one key difference would be using the Spencer Trust Fund to cover the tax breaks for those who qualify.

There is plenty of money in the fund, Klepper said. Initially, the fund held approximately $4 million — the money was given to the town by late resident Wilton Spencer and earmarked for the poor and unfortunate of Barrington. Officials decided that money earned off the fund could be given to those in need. If the fund earned 5 percent annually, officials could use $200,000 to help residents.

“Now it’s worth $5.7 million. The thing has grown,” Klepper said. “Why not use that as the bank? If I gave you $1,000 a year. It’s like a micro-reverse mortgage. You pay it off after you die or move into assisted living. For the family of the deceased to keep the property, they have to pay off the lien.”

Klepper said the program, if adopted by town officials, would help longtime Barrington residents stay in their homes. He said not all senior citizens are looking to downsize, as that process might bring about difficult decisions.

“One of the biggest challenges is making the decision about what I keep, what I don’t keep,” Klepper said. “Artwork and memories… If I die, my kids are going to have to worry about it. I don’t want to have to worry about what piece of art I take, what chair I take. What do I do with this? That’s a huge decision to make.”

Klepper said downsizing into a smaller home also has other challenges: “If I downsize and buy a house, it’s going to be very expensive anyway, and the rate’s going to be 7 percent or more.”

Initial feedback

Klepper was hoping town officials would welcome his plan.

“The Council sends this to the town solicitor who comes back with a letter that says you have to go through some processes if you’re going to do this,” Klepper said. “But it’s also, ‘We don’t want you to do this, you could get sued. You’re not helping the people, you’re helping the town.’”

Klepper disagreed with that statement.

“This is boloney. You’re helping the people who need the help now. They may be ‘house poor.’ It’s ‘poor and unfortunate.’ The poor and unfortunate of Barrington are different than the poor and unfortunate of Central Falls or Warren or Providence,” Klepper said. “It’s a different group.”

Klepper said tax exemptions or tax freezes offered by some other communities in Rhode Island are actually hurting those towns’ municipal governments.

“The towns are suffering,” he said. “This is a problem.”

Klepper said using the Spencer Trust to assist with the senior tax relief in Barrington would be win for residents and the government. He also said it would not violate the mission of the Spencer Trust.

“Instead of doing it to fix a roof or fix something else, which we haven’t needed, this way you would help the senior,” Klepper said. “Finally, even if someone sued and won at least the council could say ‘We tried.’”

Klepper is currently working with a group of volunteers to identify the best way to contact the older residents in town.